Need help?

How to set up the connection with TA

You can activate your account to report all documents issued in real-time.

Follow the steps:

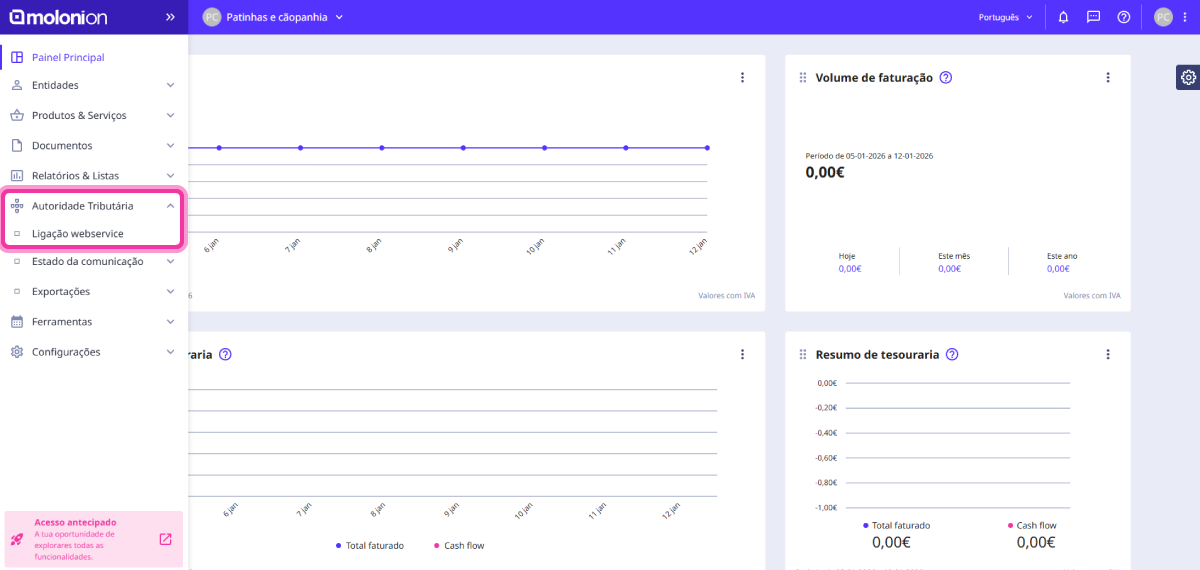

1. Go to the menu Tax Authority and click Web service connection.

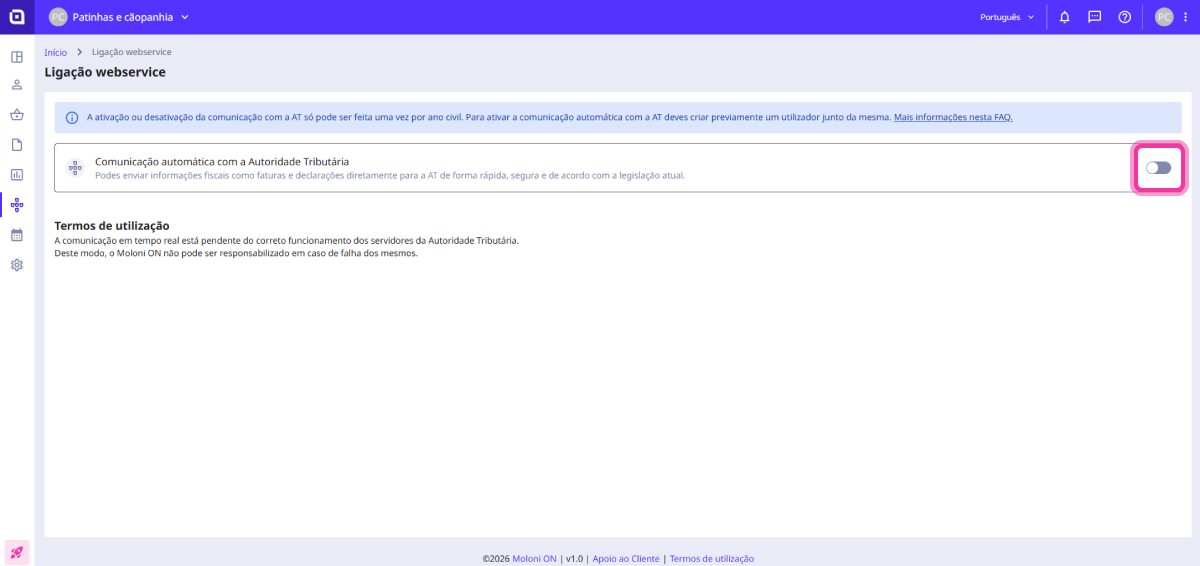

2. Activate the option Automatic communication with the Tax Authority.

Communication with the TA can only be activated once per calendar year. After deactivation, it can only be reactivated in the following year.

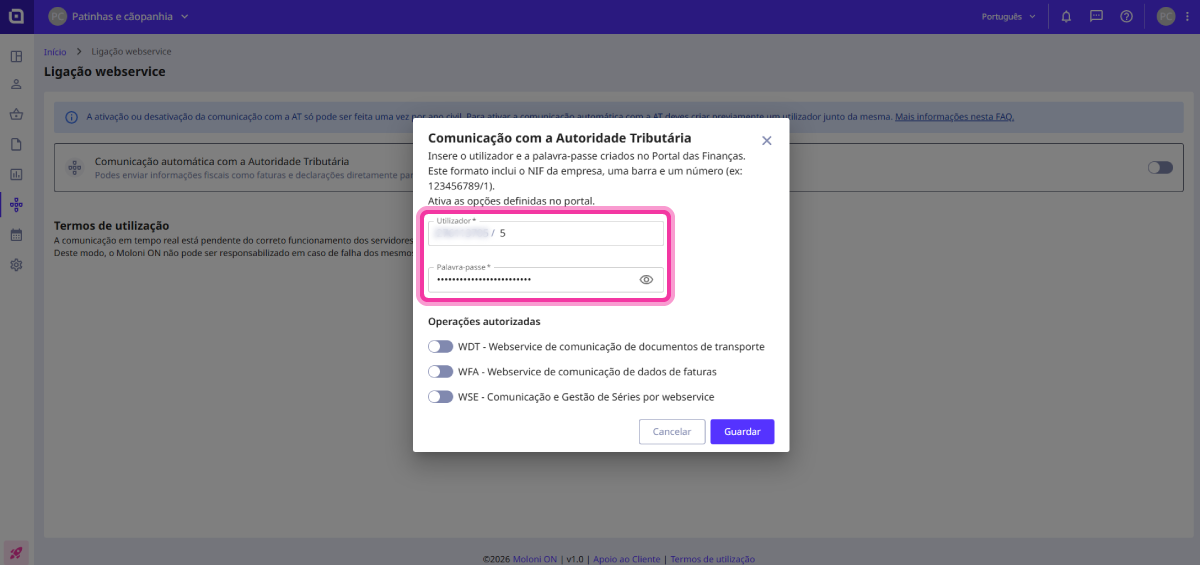

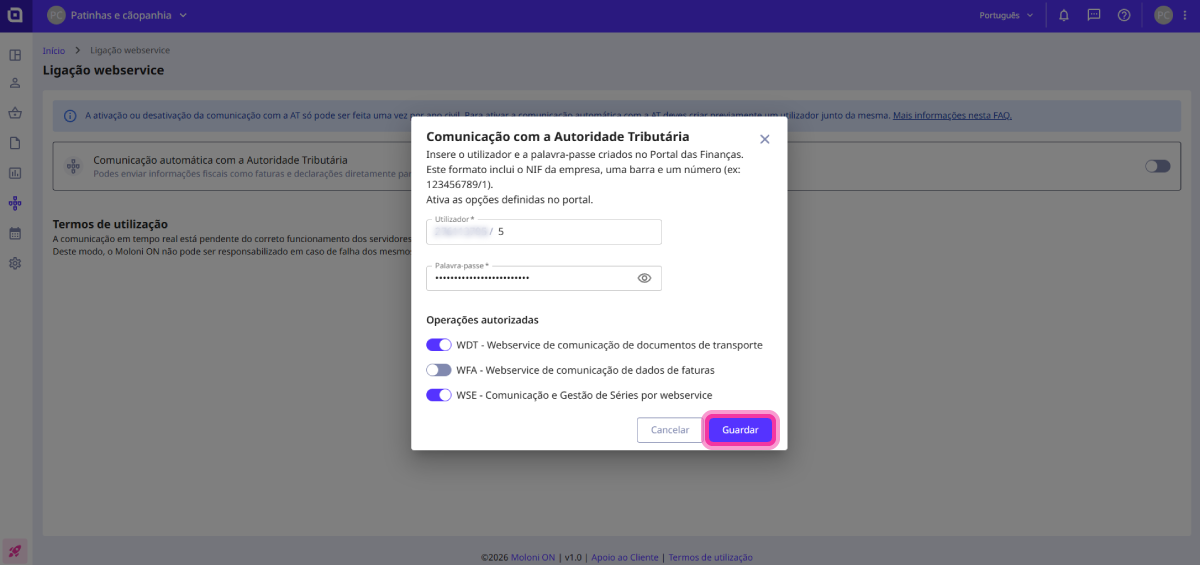

3. Enter the user created on the TA website and the password.

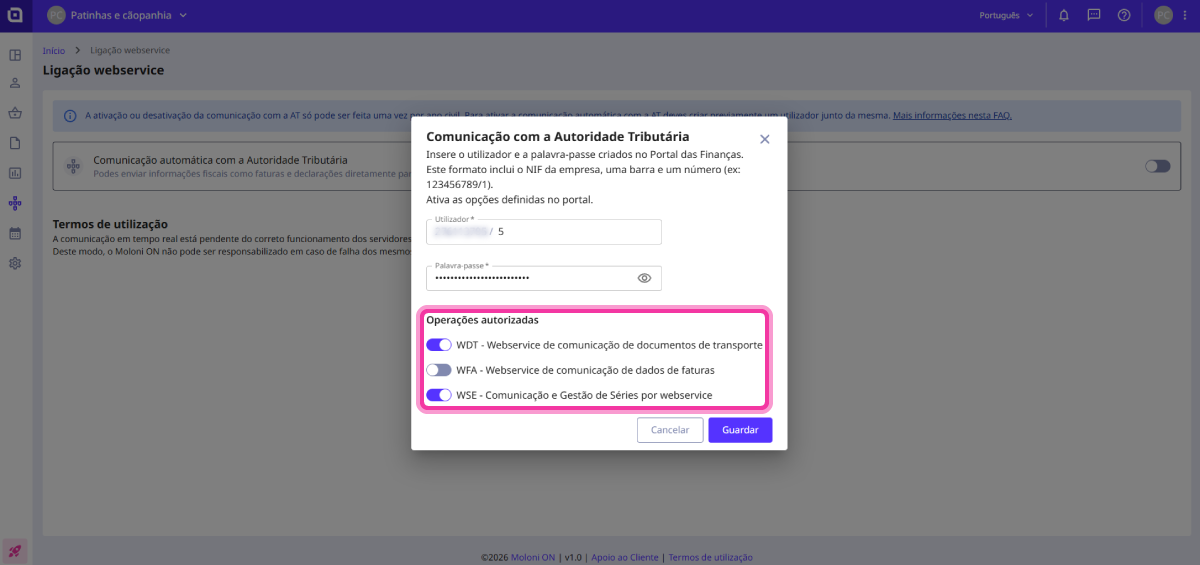

4. In the Authorised Operations section, select the desired operations.

5. Click on Save.

According to Decree-Law No. 198/2012 of 24 August, all persons, whether singular or collective, who have their head office, permanent establishment, or tax domicile in Portuguese territory and carry out operations subject to VAT there, are obliged to communicate the details of invoices issued under the terms of the VAT Code to the Tax Authority (TA), by electronic data transmission, through one of the following means:

- By real-time electronic data transmission, integrated into an electronic invoicing program;

- By electronic data transmission, by submitting a structured standardised file based on the SAF-T (PT) file, created by Ministerial Order No. 321-A/2007, of 26 March, amended by Ministerial Order No. 302/2016, of 2 December, containing the invoice details;

- By direct insertion on the Portal das Finanças;

- By another electronic means, under terms to be defined by Ministerial Order of the Minister of Finance.

Check if:

- You have invalid tax identification numbers for your clients. There may be an error in a client's tax number.

- All products have an associated VAT rate or an exemption reason in case they do not charge tax.

If the problem persists, please request our help via email.